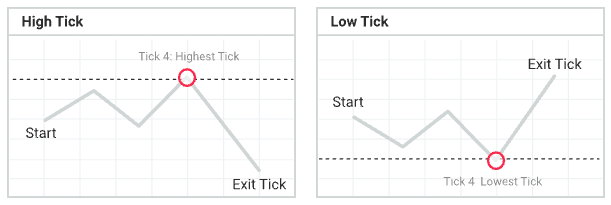

Highest/Lowest Tick

Predict which of the next 5 ticks will see the highest or lowest market price.

If you select "High Tick", you win the Payout if the selected tick is the highest among the next five ticks.

If you select "Low Tick", you win the Payout if the selected tick is the lowest among the next five ticks.

Trading Flow

-

Authorize using your token: Call authorize API using your token. Ensure that the token has the trading scope enabled.

-

Fetch Available Instruments: Use the active_symbols API to retrieve a list of all trading instruments offered on Deriv.

-

Get Contract Details: Using the contracts_for API, obtain a list of contracts available for a specific instrument.

-

Request a Price: Use the proposal API to get a quote. This will return an ID for the proposed trade.

For the High/Low Tick options:- Use the the

contract_type:- For High Tick, use: "

TICKHIGH" - For Low Tick, use: "

TICKLOW"

- For High Tick, use: "

- Use the the

-

Buy the Contract: Execute the trade by using the buy API with the ID from the proposal response. This action returns a unique

contract_id. -

Monitor the Contract Status: Check the contract’s progress or outcome using the proposal_open_contract API with the

contract_id. -

Close the Contract Early (if Needed): If you want to exit before the contract’s expiration, use the sell API with the

contract_id.

Updated 3 months ago